Facts About Offshore Account Revealed

Table of ContentsThe 8-Second Trick For Offshore AccountLittle Known Questions About Offshore Account.Get This Report on Offshore AccountOffshore Account for Dummies

2 usual misunderstandings regarding offshore banking are that it is illegal as well as that it is only for the super-wealthy. As an expat you can utilize overseas banking lawfully and also to your advantage.An offshore bank account is typically made use of by those that have little faith in their regional financial industry or economy, those who stay in a much less politically secure nation, those that can properly prevent tax in their new country by not remitting funds to it, as well as expats who desire one centralised savings account source for their global monetary demands.

Maintaining a financial institution account in a country of domicile makes substantial and long-lasting feeling for many migrants. Unless you're attempting to alter your nation of domicile and cut all connections with your home nation for life, maintaining a banking visibility there will indicate that if ever before you intend to repatriate, the course will be smoother for you.

Your company may demand you have such an account right into which your salary can be paid each month. You might likewise need such an account to have energies attached to your brand-new home, to obtain a cellphone, rent a home, raise a mortgage or buy an auto.

9 Simple Techniques For Offshore Account

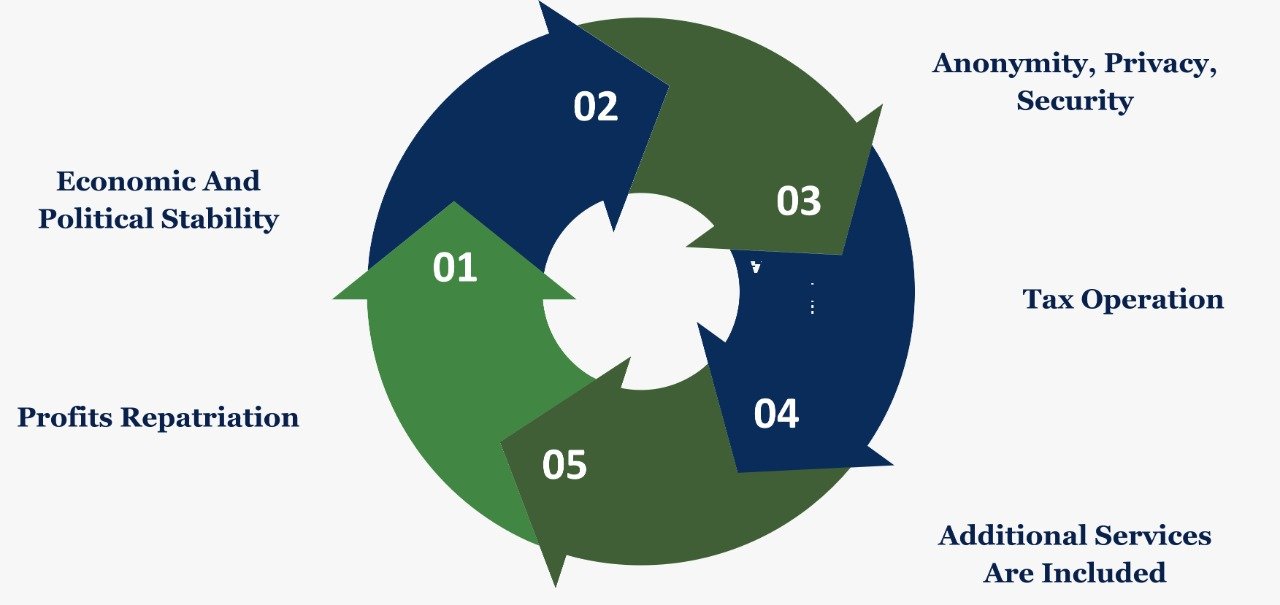

The important things to remember is that offshore financial isn't necessarily a perfect solution for each deportee. It is essential to recognize what benefits and disadvantages offshore banking has and also exactly how it suits your personal scenario. To help you decide whether an offshore savings account is right for you, right here are one of the most famous advantages and downsides of offshore banking.

If the country in which you live has a much less than beneficial financial environment, by maintaining your wealth in an offshore financial institution account you can prevent the dangers in your brand-new nation such as high inflation, money decrease or also a coup or battle. For those expats staying in a nation where you just pay tax on the money you remit right into that nation, there is an apparent tax obligation benefit to maintaining your money in an overseas checking account.

Deportees can gain from this despite where they remain in the globe as it can indicate they can access their funds from ATMs or online or look at this website over the phone at any type of time of the day or night, no matter what the moment zone. Any kind of passion earned is usually paid free from the deduction of taxes.

The Basic Principles Of Offshore Account

Keep in mind: professional estate preparation guidance requires to be sought by anyone looking for to take advantage of such an advantage. Some overseas banks bill less and some pay even more passion than onshore financial institutions. This is coming to be much less and much less the situation nowadays, but it's worth looking very closely at what's readily available when looking for to develop a new offshore bank account. offshore account.

Less government intervention in offshore monetary centres can indicate that overseas financial institutions have the ability to provide more fascinating financial investment solutions and options to their customers. You may profit from having a partnership manager or personal savings account supervisor if you select a premier or exclusive overseas checking account. Such a solution is of benefit to those who desire an even more hands-on approach to their account's monitoring from their financial institution.

as well as enable you to wait for a certain price before making the transfer. Historically banking offshore is probably riskier than financial onshore. This is shown when taking a look at the results from the Kaupthing Singer as well as Friedlander collapse on the Isle of Man. Those onshore in the UK who were impacted locally by the nationalisation of the bank's parent firm in Iceland obtained complete payment.

The term 'offshore' has come to be identified with prohibited and also immoral money laundering as well as tax obligation evasion task. Possibly anybody with an overseas financial institution account could be tarred, by some, with the exact same brush also though their offshore banking task is wholly legitimate. You need to select your overseas territory meticulously.

Offshore Account Things To Know Before You Get This

It's crucial to look at the terms as well as problems of an overseas financial institution account. It can be much more challenging to fix check my blog any type of problems that may emerge with your account if you hold it offshore.

And as well as abiding with these robust requirements, expats might still be able toenjoy more privacy over here from an offshore bank than they can from an onshore one. This factor alone is adequate for lots of people to open up an overseas bank account. There can be expat tax obligation benefits to making use of an overseas bank -yet whether these use in your instance will certainly depend on your personal conditions, such as country of home.